Deep experience, exploration and opportunities.

Mantle is a highly experienced, pioneering prospecting company built on the chemistry of pragmatism and data-informed science balanced with proven commercial acumen.

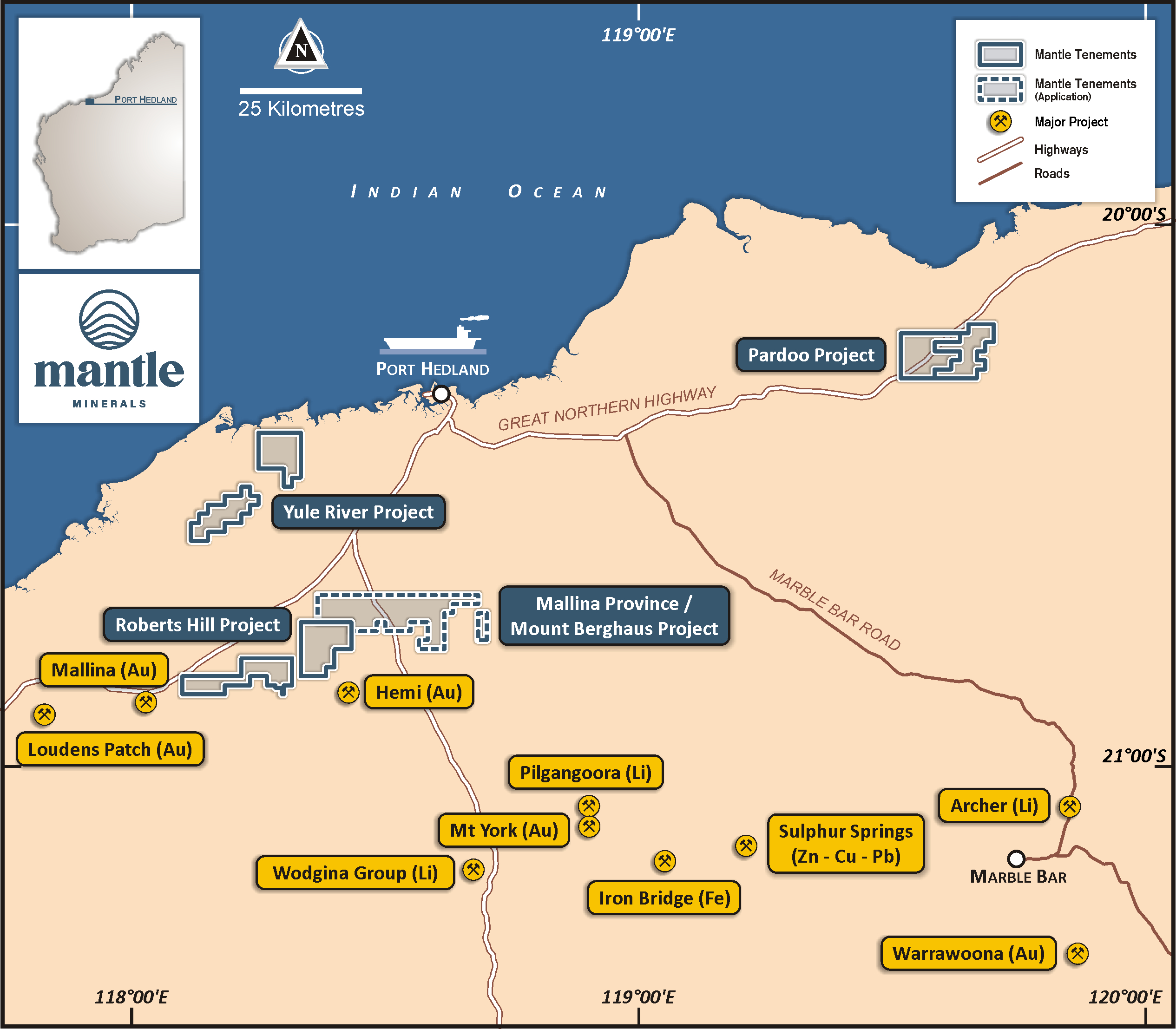

Our gold tenement holdings are large and strategic

The Pilbara region is only just beginning to open up with some of Australia’s largest new discoveries such as the 10.6M oz Au Mallina Gold Project, within 5km of our Robert’s Hill Tenements. This gold project is the focus of Mantle’s activities in 2023.

We are also exploring a large mineralised nickel-copper sulphide system at Pardoo, open down dip and along strike to the east and west for over 900km, whilst our Li projects in Nevada are a foothold in the right place at the right time.